The transaction was subject to customary closing conditions, including anti-trust approval, that have been fully satisfied as of 8 October 2020. The purchase price on a cash and debt free basis was paid with EUR 128m in cash and 2.9 million Marel shares.

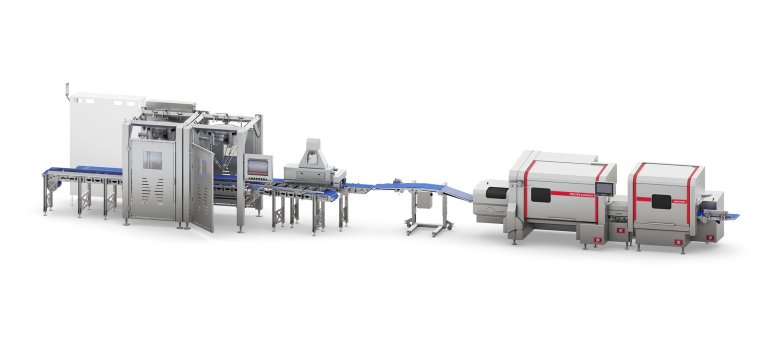

With the acquisition of TREIF, two technological leaders with a shared passion for innovation and a vision to transform the way food is processed, join forces. TREIF has around 500 employees and EUR 80 million in revenues, and is highly focused on innovation and cutting-edge technology, backed by an experienced and committed team and long-standing partnerships with customers. TREIF’s product portfolio in the cutting segment, portioning, dicing and slicing is highly complementary with Marel’s product portfolio.

The transaction will enhance Marel’s full-line offering for the meat industry, as well as its other segments focused on improving automation, food safety and flexibility for consumer-ready product offerings. United, the two companies are in a stronger position to drive further growth, providing better value for both current and future customers.

For further information on the TREIF transaction, Marel’s business model and 2017-2026 growth strategy, please visit marel.com/IR